Introduction

In recent years, business rescue has emerged as a crucial mechanism in South Africa to salvage struggling companies and mitigate the adverse impact of corporate distress on the economy. As business rescue practitioners, we have conducted a comprehensive analysis of data sourced from the Companies and Intellectual Property Commission (CIPC) to shed light on the effectiveness and impact of business rescue in the country. Our findings challenge prevalent perceptions and showcase the remarkable contributions of this process to the South African economy.

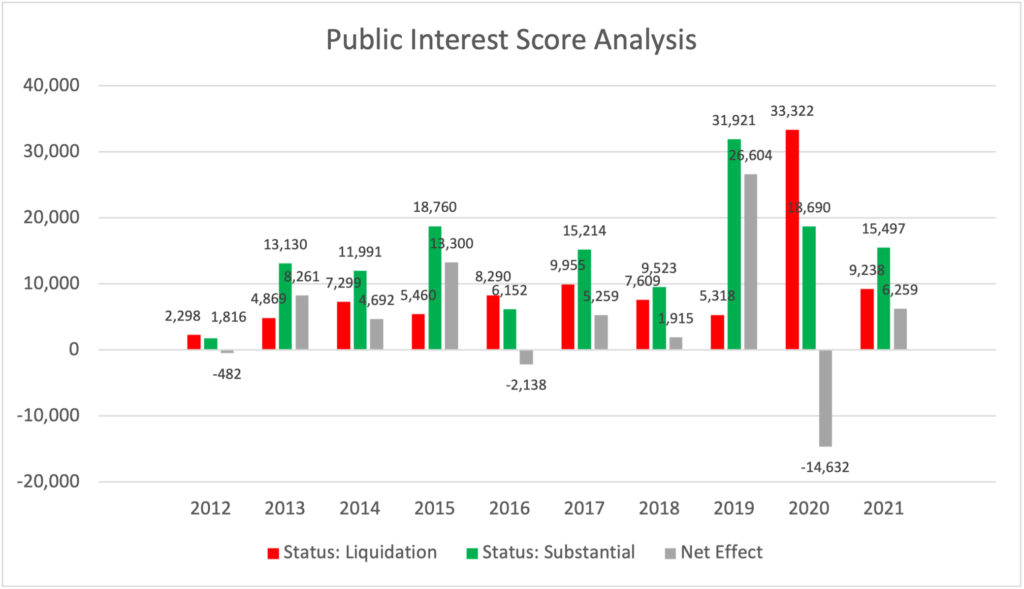

Understanding the Public Interest Score

Public Interest Score (“PI Score”) is the measure of public interest in a specific company, determined by considering the potential social footprint of the company and its potential impact on the public. To gauge the economic value of companies undergoing business rescue, one looks to the public interest score, calculated by considering four key factors: annual turnover, debt, the number of employees, and shareholders. For every R1 million in annual turnover or debt and every employee or shareholder, a company receives one point. This score is indicative of the economic effect a company has on the national economy.

Business Rescue Implementation and Success Points

The culmination of the business rescue process is marked by specific success points defined in the business rescue plan. These points indicate that the business rescue plan has been fully implemented, enabling the business to transition from distress to operational stability and growth.

Impactful Business Rescues

According to the data obtained from the CIPC, the total successful business rescue matters filed for the years 2012 – 2022 at CIPC amount to an impressive 142,695 PI Score points, while liquidations scored 93,657 PI Score points. This substantial difference underscores the efficacy of business rescue legislation, saving more value than what was lost in the liquidated companies.

Crucially, we have excluded the data for the first and last year due to data inefficiencies in 2011, and most of the 2023 matters are still active.

The Net Positive Effect

Subtracting the total PI Score points of the liquidations from the PI Score of the successful business rescues, the net positive effect of business rescue for the years under review is a significant 49,037 points. In terms of economic value, this could amount to a staggering R49,037,000,000 positive benefit to the South African economy. These figures serve as compelling evidence of the tangible benefits business rescue brings to individual companies and the broader economic landscape.

Challenging Perceptions

Our analysis challenges prevailing perceptions surrounding business rescue. Contrary to misconceptions about its effectiveness, the data illustrates that the process is yielding remarkable results far beyond what may be perceived by the public. By salvaging struggling companies, business rescue not only preserves jobs and investor interests but also bolsters the nation’s overall economic health.

Conclusion

Business rescue in South Africa has proven to be a powerful tool for reviving distressed companies and substantially impacting the national economy. The data from the CIPC showcases that business rescue is more effective than commonly believed, turning around businesses that may have otherwise faced liquidation. This mechanism is vital in fostering economic growth, employment stability, and investor confidence in the country. As business rescue practitioners, we remain committed to navigating companies through financial turmoil and paving the way for a brighter economic future in South Africa.

Stefan Steyn and Tim Stokes