BLOG

Identity versus Image: Aligning the Two Pillars of a Successful Brand

In a crowded marketplace, your brand competes not only on products and pricing but on perception. Every logo tweak, every social post and every customer

A Win for Business Rescue: SCA Confirms SARS Cannot Set Off Pre-Rescue Tax Debts

On 12 May 2025 the Supreme Court of Appeal’s decision, in Henque 3935 CC t/a PQ Clothing Outlet v Commissioner for the South African Revenue

FINAL DEREGISTRATION AT THE COMPANIES AND INTELLECTUAL PROPERTY COMMISSION (“CIPC”) – NEW UPDATE

The Companies and Intellectual Property Commission (“CIPC”) recently provided updated criteria for the reinstatement process for Companies and Close Corporations that were deregistered due to

Employment Equity Amendment Act, No 4 of 2022 – For current implementation

The President of South Africa has issued a proclamation in terms of which the amendments to the Employment Equity Act, 1998 (EEA), which were signed

Solar System Caution: Ombud and Insurers Warn of Rising Risks

The Consumer Goods and Services Ombud (CGSO) has issued a cautionary notice to current and prospective solar system owners, citing a surge in complaints and

The Importance of Regularly Having Your Trust Deed Reviewed

Failure to review a trust deed from time to time can cause serious legal and financial problems, disputes, and adverse consequences for beneficiaries. The key

Market value and the characteristics of agricultural property

Farms are bought and sold, sometimes as businesses, sometimes because they are enjoyable places to live, sometimes as investments, and sometimes as insurance against a

Practical Guidelines for Trustees of Family Trusts

A family trust is a popular and effective estate planning tool, enabling individuals to protect their assets, provide for their families, and ensure smooth succession

Write-off or Compromise of Tax Debt: Understanding Sections 192 to 207 of the Tax Administration Act

Tax debt can be a significant burden for individuals and businesses alike, often leading to financial distress. Fortunately, under sections 192 to 207 of the

Asset Refinance – Beacon Of Optimisation

Refinancing emerges to become a beacon of financial optimisation and scaling growth. Refinancing of existing debts or the refinance of an asset, whether paid off

South African Inheritance: A Guide to Offshore Beneficiaries

Inheriting assets from a South African estate when the beneficiary resides overseas can involve various legal, tax, and regulatory considerations. These processes are governed by

Business Rescue in 2024 – A Crucial Opportunity for Accountants to Lead Corporate Recovery

In recent years, business rescue has become a critical lifeline for financially distressed companies in South Africa. Introduced by the Companies Act 71 of 2008,

The Brand Messaging Checklist

Effective brand messaging is essential for communicating your business’s value and connecting with your audience. Here’s a checklist to ensure your brand messaging resonates and

How to handle the probation period as an employer

Probation is dealt with in terms of the Code of Good Practice – Dismissal, contained in Schedule 8 to the Labour Relations Act. This document

Managing USD/ZAR Volatility Amidst Global Political Uncertainty

In the face of political and economic uncertainty, such as the recent attempted assassination of Donald Trump and Joe Biden’s withdrawal from the presidential race,

Key considerations for the acceptance and continuation of client relationships in auditing

In the ever-evolving world of auditing, maintaining integrity and upholding the highest standards is as important as ever. The foundation of a successful audit engagement

The Advantages of Commercial Finance for Small Businesses in South Africa

In South Africa, small businesses form the backbone of the economy, driving innovation, employment, and economic growth. However, one of the significant challenges they face

6 Reasons Why Branding is Important in Marketing

What is Branding? Branding is creating a unique identity for a product, service, or company. It involves shaping how customers perceive and connect with a

Navigating the Tax Implications for Personal Service ProvidersNavigating the Tax Implications for Personal Service Providers

The tax landscape in South Africa can be complex. The term ‘Personal Service Provider’ refers to a specific category of taxpayer defined by the South

Servitude Valuations

The definition of Market Value implies that it is the most probable price it will sell for. Not the highest or lowest possible price. Servitude

Rights of beneficiaries in discretionary trusts

Introduction Discretionary trusts in South Africa are popular estate planning tools, allowing individuals to manage and protect their assets for the benefit of their loved

Input VAT and motor cars

Input VAT and motor cars A vendor is generally not entitled to deduct input tax on the acquisition of a motor car, irrespective of whether

Protecting Professionals: The Vital Role of Professional Liability Insurance

In today’s increasingly litigious world, professionals across various industries face a growing number of lawsuits and legal claims. As a result, the importance of having

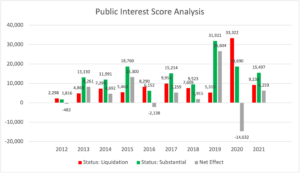

Business Rescue in South Africa Proving its Worth: An Analysis

Introduction In recent years, business rescue has emerged as a crucial mechanism in South Africa to salvage struggling companies and mitigate the adverse impact of

Why Your Company Desperately Needs a New Look (Before It’s Too Late!)

Picture this: your company’s logo and branding are stuck in the past like a pair of bell-bottom jeans. You know it’s time for a makeover,

Settlement agreement on Employment Equity

On 28 June 2023, the South African government and the Solidarity Trade Union signed a settlement agreement on employment equity. Employment and Labour Minister, Mr

What are the recent trends in auditing?

Artificial intelligence (AI) is transforming every industry and organisation. The rising use of AI and automation is one of the most significant trends that will

The accuracy of municipal valuations

Municipal Valuations are not accepted as accurate by SARS (potential tax purposes), and it is not accepted as accurate by the SA courts in litigation

Testamentary Trusts – what you should know

A trust may be established in various ways. The two most common ones are either through a contract (between living persons) or by way of

Solar Panel Tax Incentive

Solar Panel Tax Incentive for Individuals The objective of the newly announced solar panel tax incentive for individuals announced by the Minster of Finance in